What changes will arise from the 2025 property tax reform?

Property owners pay tax (Grundsteuer) on their owned property once per year. The tax is collected from cities, municipalities, and communities and is calculated according to the property and building value. This tax also has an effect on rental tenants due to the property tax affecting the operating costs (Betriebskosten) and thus, also a part of the rental price.

The current property tax rates are based on values that date back to 1964 in old federal states and 1935 in new federal states. The standard values have changed only minimally and selectively since then, such as when there are significant increases or decreases in value or when there is a change of owners. Usually, the local tax office for these properties still uses the previous standard value when calculating property tax.

It’s no big surprise that the Federal Constitutional Court initiated a property tax reform in 2018 as the standard value has long since ceased to correspond to today’s modern property values.This ensures that property tax is based on its current worth leading to a more fair and simpler valuation process.

The property tax reform introduces new assessment bases for each of the approximately 36 million economic units for property tax purposes from the calendar year 2025 onwards.

The previous procedure for determining property tax will remain:

Property tax value x Basic federal rate x Assessment rate

Property tax value (Grundsteuerwert): Determined by the tax office based on a property tax return (Grundsteuererklärung) Basic federal rate (Steuermesszahl): Determined by law Assessment rate (Hebesatz): Determined by the respective city or municipality

New property tax values are to be determined for properties owned as of or before January 1st, 2022, these values will be the basis for the new property tax implemented in 2025.

The following information is required for residential properties:

- Property location

- Property area

- Standard ground value (Bodenrichtwert)

- Building type

- Living space area

- Year of construction

Property owners who owned their property as of or before January 1st, 2022, must submit this information to their local tax office in the form of a property tax return.

Who is required to file a property tax return?

Property owners who owned their property as of or before 01.01.2022 are required to submit a property tax return.

To which tax office do I have to submit my property tax return?

The tax office is determined by the property’s location.

How should a property tax return be filed?

Property tax returns should be filed electronically.

When is the deadline for property tax returns?

Property tax returns must be filed between July 1st, 2022 and October 31st, 2022.

What happens after I file a property tax return?

Following a property tax return submission, the tax office will issue an assessment notice determining the new property tax value.

Do property tax returns have to be filed annually?

No, property owners are only required to file in 2022 unless the property was in shell condition (Rohbau) on the cut-off date and construction work was completed in the meantime. In this case, a subsequent return must be filed.

What if a property was purchased on January 2nd, 2022 or later?

Nothing. Only owners who are in the land register (Grundbuch) on January 1st, 2022 or before are required to submit a property tax return.

What information is necessary for the property tax return?

- Property size

- If available, land register sheet number (Grundbuch)

- Municipality (Gemarkung)

- Land parcel (Flurstück)

- The property’s tax number (Steuernummer) / File number (Aktenzeichen)

- Standard ground value (Bodenrichtwert)

For owned apartments:

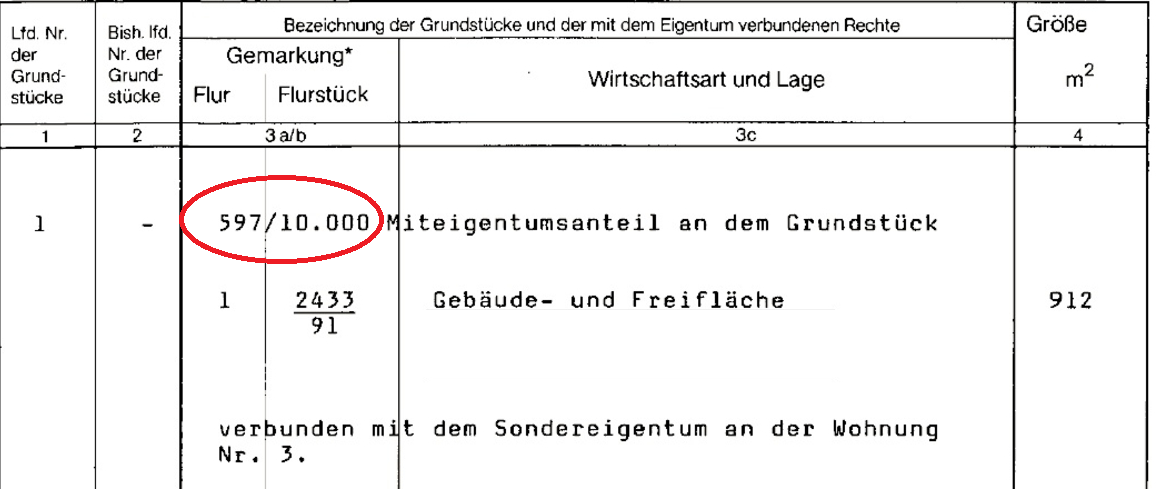

- Owned share of the property (share belonging to the economic unit: numerator/denominator)

Where can I find “Share of the economic unit: Numerator/Denominator?”

“Share of the economic unit” describes the part of the property belonging to an owner on a shared property with multiple owners. The value determines how many fractions of a common property belonging to one person. Your share (e.g. 1/1 or 1/2) can be found, for example, in the land register (Grundbuch) under the owner (Eigentümer) header or in a declaration of division (Teilungserklärung) / cadastral excerpt (Katasterauszug) under ownership information (Angaben zum Eigentum). Numerator describes the first number in the fraction and denominator the second number in the fraction. For example, if you share a property with another owner and you each own half of the property, enter 1 as the numerator and 2 as the denominator.

This information can be found in:

- The land register (Grundbuch)

- Purchase contract (Kaufvertrag)

- Declaration of division (Teilungserklärung)

- Cadastral excerpt (Katasterauszug)

Here is an example of the information found in the land register: